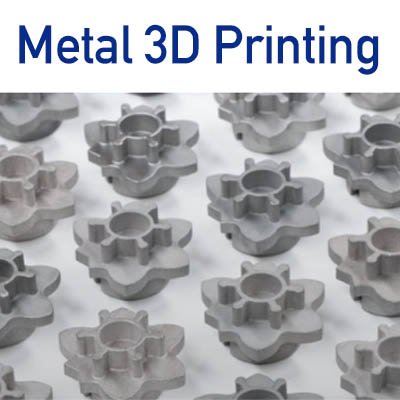

Desktop Metal Studio Sytem 2 Upgrade

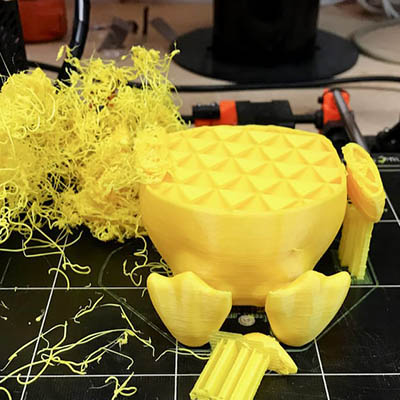

Desktop Metal released a great lineup of 3D printers last year and we will recap some of those exciting new machines in weekly blog posts this month. Many of these new printers will also be showcased in our upcoming 3D Printing Online Seminar Series which will happen over the next couple of months. Please stay tuned for more details on that and in the meantime let's take a look at one of the new releases [...]